Own Your Financial Future & Change Your Life: Take the Strategic Lead in Your Retirement Journey Today!

Transform Your Life: Lead with Strategic Planning!

In today’s ever-changing economy, relying solely on a 401(k) may not be enough to secure your financial future. It’s time to take control and explore new avenues that can provide the growth and stability you need.

Our free Retirement Scenario Calculator is designed to help you do just that. Imagine a retirement where your savings are maximized, and your financial future is secure. By leveraging both a 401(k) and an IRA, you can strategically diversify your investments, spread risk, and significantly boost your returns. This powerful tool empowers you to compare the benefits of combining these investment vehicles versus relying on a 401(k) alone, giving you a clear vision of how to enhance your retirement savings.

Are you ready to take control of your financial destiny? Our Retirement Scenario Calculator is crafted for individuals like you who want to make informed, strategic decisions about their retirement savings. By comparing different investment strategies, you can optimize your retirement plan and achieve greater financial security.

Why Choose Our Calculator?

Maximize Your Returns

Imagine seeing your retirement savings grow exponentially by strategically combining a 401(k) with an IRA.

Visualize Your Future

Picture a clear, detailed roadmap of your financial future with personalized projections tailored to your unique situation.

Make Informed Decisions

Feel the confidence of making smart, well-informed investment choices that could change your financial destiny.

Achieve Financial Security

Envision a secure, prosperous retirement where your investments work as hard as you do, ensuring peace of mind and financial freedom.

How It Works

Input Your Data

Enter your current financial information, including salary, age, retirement age, and current retirement savings.

Adjust Your Contributions

Picture a clear, detailed roadmap of your financial future with personalized projections tailored to your unique situation.

Analyze the Results

See the potential future values of your investments and understand which strategy works best for you.

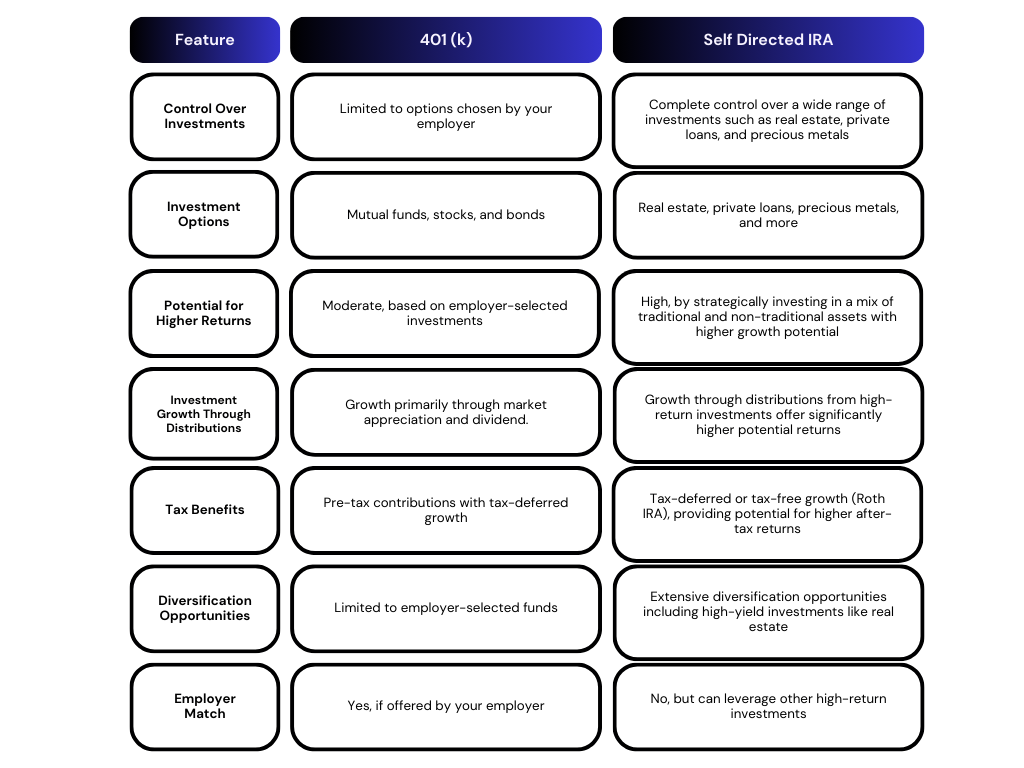

What's the difference between a 401k vs a Self Directed IRA & WHY it matters.

Your 401(k) offers stability and employer matches, but it doesn't have to be your only investment strategy. By combining it with a self-directed IRA, you can take advantage of high-return assets like real estate and private loans, gaining both control and flexibility to maximize your returns. This powerful combination allows you to spread risk and boost your growth potential, creating a more secure financial future.

Download our free Retirement Scenario Calculator today to test your current scenario and see how leveraging both a 401(k) and a self-directed IRA could transform your retirement. Discover how your financial future can take on a whole new light with strategic planning.

Educational Purpose Disclaimer: This information is provided for educational purposes only. It offers general insights based on the inputs you provide and should not be construed as financial advice. Always consult with a financial advisor for personalized financial planning.

Real Life Scenario

Maxing Out the 401(k)

John is 45 years old and earns $100,000 annually. He decides to maximize his 401(k) contributions, investing $22,500 each year until retirement at age 65. With an average annual return rate of 7%, John’s 401(k) grows steadily. By the time he retires, John has accumulated approximately $1,210,000 in his 401(k). While this provides a solid foundation, John wonders if he could have optimized his savings even further.

Combining 401(k) with Self-Directed IRA

Lisa is 50 years old and earns $120,000 annually. She contributes 10% of her salary to her 401(k) and her employer matches 5%. Additionally, Lisa invests $6,000 annually into a self-directed IRA, focusing on real estate and private loans with an average return rate of 13%. By the time she retires at 65, Lisa’s combined retirement savings from her 401(k) and IRA amount to approximately $1,700,000, showcasing the power of diversification and strategic investment.

Focusing on Self-Directed IRA

Sarah is 31 years old and earns $90,000 annually. She decides to contribute only to a self-directed IRA, investing $6,000 each year in high-return assets like precious metals and private equity, with an average annual return rate of 13%. By the time Sarah retires at 65, her self-directed IRA has grown to around $4,000,000. Although she doesn’t benefit from employer matching, her focused investment strategy yields significant returns, demonstrating an alternative approach to retirement planning.

This calculator is intended for educational purposes only. It provides general information and estimates based on the inputs you provide. The results are calculated using historical average return rates and do not account for future market trends, fluctuations, or unforeseen economic events. Always consult with a financial advisor for personalized financial planning and to understand how different investment strategies may impact your unique financial situation. The information provided by this calculator should not be used as the sole basis for making investment decisions. EmpowerHer Capital Fund is not responsible for any discrepancies or financial losses resulting from the use of this tool.

© 2024 Empowher Capital